How big does a scheme need to be to run-on and do it well?

In corporate DB schemes there’s a rich debate about running-on. To do this well we think it’s mainly a function of scale, governance, and sponsor appetite.

The truth is though, settlement is a matter of when, not if.

Because a closed DB scheme pays out an ever-increasing proportion of assets in benefits, it folds in on itself. As it becomes super-mature this effect accelerates. Eventually diseconomies (and with it, the governance overhead) diminish the benefits and at that point some form of settlement makes most sense.

Our view is that to run-on successfully, a scheme in this position needs to start with about £1bn or more in assets. If retaining 'large scheme' governance and necessary resourcing, a period of up to ten years run-on should be manageable.

Pension Financials

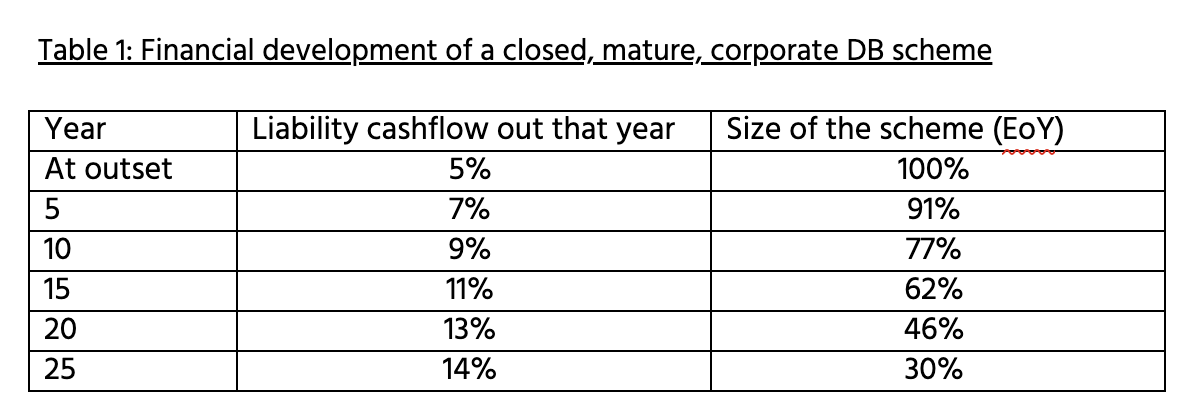

Consider a ‘typical’ closed scheme, fully funded on a conservative basis (so no contributions). Our projection assumed a yield curve generally prevailing during the first half of 2024. The balance of pensioner to deferred liability was 75:25.

We'd expect the scheme’s financial development to look something like this:

To explain a bit more, in year 15, some 11% of the assets at that time are paid out in benefits. At the end of that year the fund has fallen to 62% of its starting value, a combination of investment returns (+ve) and benefits paid out (-ve). The more mature, the more the balance shifts which means paying out income, but in addition, an ever-increasing proportion of capital.

The Benefit – Or Strain – To The Sponsor

All sponsors are different but let’s consider a company doing well enough. Compound sponsor growth of 5% (say) would mean, after 10 years, a company more than 60% bigger. And after 15 years, twice as big. This will be more pronounced for sponsors already large relative to scheme size.

We generalise for impact but could see such sponsors continuing to support schemes running-on up to 10 years (and at a stretch, 15 years), but not much beyond. The compounding effect is powerful. Relative financial firepower (for example, for surplus generation) is diminished, a function of corporate growth and reducing scheme size.

For sponsors struggling (say with reducing earnings and balance sheet), or small relative to scheme size, there will have to be a fine balancing act between appetite and ability to bear risk, and trustee willingness to see the upside for members.

The Impact of Scheme Running Costs

The Table above doesn’t allow for operating expenses as these (and broader consideration like sponsor size, growth etc.) are specific to each scheme. For very large schemes (£10bn+) this is much less of an issue.

However, our sense is that pension service companies – like administrators, asset managers, advisers and so on will experience internal cost pressure driven by increasing scarcity of resource. This will manifest in service price inflation, especially in the provision of admin and other support services. And as assets fall, managers charge a higher ad valorem fee.

Some time ago (2014), TPR looked at a range of scheme costs and found that diseconomies kicked in after assets fell below £500m. This became acute at the smaller end, where in relative terms, schemes became about four times as expensive as large ones to run. There may be extra advisory, monitoring and admin spend linked to (say) extraction of surplus alongside benefit enhancements. Whilst TPR's original analysis could certainly benefit from updating, these rising costs (and a falling asset base) should definitely be factored into any business case to 'run-on'.

Our analysis does not explore the extent of 'profit' which could be generated by different investment strategies, we leave that to scheme advisers. But we remain cautious about claims made of extra 'carry' beyond 50bps, without distorting investment strategy, and hence financial risk. A more reasonable expectation, after costs, may be nearer 25bps, this of course the starting point, where our claims regarding future financial firepower and (dis-)economies of scale through time should still be factored in.

Summing Up

Whilst all schemes and sponsors are different, we wonder whether a starting point for ‘purposeful run-on’ might be upwards of £1bn. A likely case could then be made for run-on of about 10 years. After 15 years the scheme will have contracted by 40% but a moderately growing company will have doubled in size. Financial firepower (e.g. for surplus or funding a DC section) will have diminished. Scheme running costs will experience diseconomies of scale and it would seem reasonable to assume real (i.e. inflation plus) increases in support services, with increases in ad valorem investment fees.

Governance Implications

At best, a managed run-off should be underpinned by a properly thought through business case which considers both financial and governance issues:

Financial:

Assess the scheme funding and sponsor finances through (we suggest) the next 10 years

Weave in running and other operational, advisory, fund management and project costs, including settlement

Different investment strategies

Allow for risks (scenarios would help)

Governance:

Consider the target operating model needed to deliver success

Define the current and future states (and interim steps), and risks

Recognise the shift in emphasis towards operational excellence (a smaller range of asset classes, needing to sell assets down at the right time, and controlling cost)

Retain (or attract) core skills and experience with appropriate incentives

HOW AVIDA CAN HELP:

Avida is truly independent. We have no vested interest in the outcome.

The decisions around running-on (or not), and for how long, aren't easy. Avida has expertise in supporting schemes navigate complex decisions requiring broad input but often a dynamic response. We will provide analysis and input for your decisions, acting as a ‘critical friend’ to both sponsor company and trustees.

Avida can help you plan your pension resources along the way. The skills needed through this period - even for running-on - will evolve.